How "Risky" are the Markets? -Article #2

- Colin Overweg, CFP®

- Apr 11, 2019

- 2 min read

Updated: Oct 11, 2019

"The stock market is like gambling".

This statement used to make make me so mad. How could someone be so stupid to compare:

A) The opportunity to literally be a part-owner/shareholder of thousands of the world's most successful companies, participate in their market growth and collect dividends.

vs.

B) Play a game that you KNOW damn-well the house has better odds and you're destined to lose. Even roulette has "Green" "0" and "00" so your "50/50" bet on "Black" actually has a 47.4% chance of winning!

But now, I know longer get upset with this popular opinion. In fact, I actually feel a tremendous amount of sympathy for these people; watching the markets move up and down, day after day, for no reason, must be mentally exhausting and feel a lot like gambling. And to be honest, betting on short-term market returns isn't investing - IT IS GAMBLING!

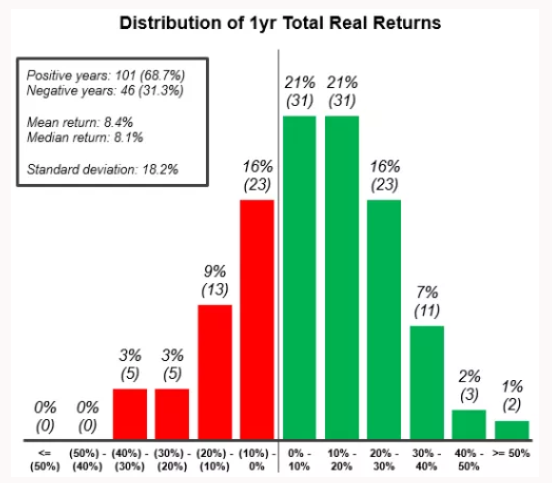

Since 1870 (147 years ago), the market has posted positive returns 101 times - 68.7%. These odds are better than betting on "Red" at the roulette table, but I'd certainly never ask you to bet your life saving on something with a 68.7% chance!

So why do I recommend virtually every one of my clients to have a portion of their long-term savings in the market?

In English please...

"One Year Market Returns" are pretty much random. Yes, one year returns are like the weather-person saying, "okay folks, the historical average temperature in this State is 50 degrees, but we've seen it as high as 95 and as low as 21. You should expect the temperature to be between 68 and 32 degrees - thanks for watching."

If your forecast was between 68 and 32 degrees EVERYDAY, would you still watch the weather report? Of course not, you'd prepare for everything. This is how you need to be investing!

"Ohhhhh, I see what you did there, Colin."

The market is up year-to-year a majority of the time, but it's still unpredictable. So let's focus on what really matters, building & sustaining long-term wealth.

When you average market returns over longer periods of time you'll find that this isn't gambling any more. The average market return over any twenty year period over almost 150 years is 6.7% (adjusted for inflation, aka add 3%) and most returns are +/- 3% of that average. And the most amazing part is that you've never lost money in the market over any 20 year period - ever.

"Ohhhhh, so investing long-term is basically the exact opposite of gambling."

My Sincere Advice

Invest in low-cost globally diversified funds

Automate your savings

Embrace the inevitable SHORT-TERM market volatility

Work with a competent advisor who can:

-Help you identify what's important to you

-Craft a plan to accomplish those goals

-Keep you accountable to the plan

-Measure your progress

-Modify the plan as your life and goals change

Comments