It's the most wonderful time of the year! (Tax Time)

- Ted Perry

- Feb 16, 2021

- 9 min read

On February 13th, the IRS officially began accepting tax returns for the 2020 tax season. I like to think of this as a sort of "opening day" for tax preparers.

Most of us tend to fall into one of two groups when it comes to filing our returns: Either we try to file as soon as humanly possible or we procrastinate until March or even April! While both of these are valid approaches (and sometimes out of our control as we try to find time with our tax preparers), there are reasons to strategically time your filing. The big reason that this year is different, has to do with the stimulus package that's currently being written and working its way through Congress.

I should preface the following information by saying two things:

The stimulus bill is a work in progress. At the time of writing this newsletter, a final bill is making its way through the various committees of the House. The current timeline suggests the matter will be brought for a vote sometime during the week of 02/22/2021. I expect that the final package will look at least slightly different than how it looks today.

This article has no opinion on the wisdom of another stimulus bill, the size another stimulus package should be, or who should be covered by a third stimulus package. Our role here is to simply try to provide useful, relevant information.

Stimulus Overview

Stimulus Overview

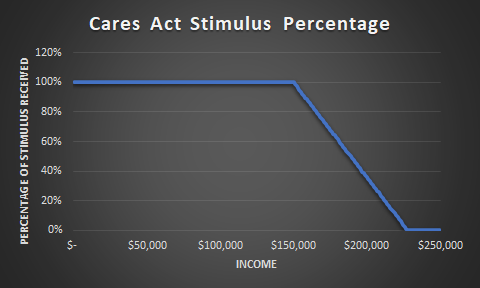

As in the past two stimulus bills, the element that is likely to be relevant to most people is stimulus checks. It's currently thought that stimulus checks (in reality direct deposit for most taxpayers) will be sent out for $1,400 per adult as well as an additional $1,400 per eligible child. The current draft of the bill still has the same thresholds of $75,000 and $150,000 of income for single and joint filers respectively. What's different this time is how quickly benefits begin phasing out. Once income exceeds $100,000 for single filers and $200,000 for joint filers, that taxpayer will receive no stimulus benefits. Especially for filers with children, this accelerated phaseout represents a pretty drastic shift in how benefits are calculated.

This reduction would mean that households who received a check from the first two stimulus packages could receive a reduced benefit or even no benefit at all!

While these income thresholds are by no means finalized, they have the potential to affect the ideal filing strategy for you and your family.

Let's explore an example:

Homer and Marge Simpson have three kids, Bart, Lisa, and Maggie and they make $205,000 per year. Under the CARES Act, the maximum amount of stimulus they were eligible to receive was $3,900 ($1,200 each for Homer and Marge + $500 for each of their children). However, because their income is so high, their payment would have been reduced to $650. Under the new stimulus plan, they would be eligible for a payment of up to $7,000 ($1,400 each for Homer and Marge + $1,400 for each of the children). If Congress kept the rules the same as they were under the CARES Act, Homer and Marge would have received $3,750 (that buys a lot of donuts!). With the new income cliff of $200,000, however, Homer and Marge wouldn't be eligible to receive any stimulus payment! I guess they will be paying out-of-pocket for those donuts after all.

Now, Homer and Marge aren't very happy about not receiving any stimulus payment this go around. Let's say that they are able to make a $6,000 IRA contribution. This contribution would reduce their taxable income to $199,000 and make them eligible for the stimulus under the new rules. After making the IRA contribution, they would be eligible for $4,550 of stimulus. The contribution to the IRA would have almost been paid for entirely by the stimulus they will receive!

How does this affect you?

When the CARES Act passed in March of 2020, there were many who had not yet filed their 2019 tax returns yet. For those taxpayers, the IRS used their 2018 tax return to determine if they were eligible for a stimulus payment. It's expected that this third round of stimulus will work in a similar manner. Taxpayers who have filed their 2020 tax return by the time the third stimulus package is signed into law will likely have their 2020 income used to determine eligibility. Conversely, taxpayers who have NOT yet filed will likely have their 2019 income used to determine eligibility. This means that there is potentially going to be an opportunity to "choose" the income that is most advantageous for you!

If your 2020 income fell from 2019 to a level that is low enough to qualify for a stimulus payment, it is likely in your best interest to file your tax return ASAP to attempt to qualify for a potential stimulus payment. Conversely, if you had an increase in income in 2020 that could cause any potential stimulus to be reduced or even eliminated, it's likely in your best interest to wait to file so that your 2019 income will be used to calculate your stimulus eligibility. If your income remained roughly the same and you received a reduced payment (or received no payment at all) the last two times, you could explore possible ways to reduce your 2020 income in order to qualify. These include things like making a deductible IRA contribution or contributing to an HSA. A unique wrinkle included in the most recent proposal provides the opportunity for the IRS to make taxpayers who miss out on benefits whole later in the year.

Let's explore an example where a taxpayer's income in 2019 qualifies them for $1,000 of stimulus and their 2020 income qualifies them for a $1,400 stimulus check. If that taxpayer doesn't file their return until after this bill has passed, their 2019 income would be used to determine the amount of the stimulus. Once that taxpayer files, the bill allows the IRS to notice that the stimulus check was too small and send the taxpayer a check for the difference ($400 in this example).

This puts less pressure on those whose income was lower in 2020 than it was in 2019 to file ASAP. That said, it's difficult to say whether this provision makes it into the final bill. In addition, it provides another opportunity for an error to be made in the calculation of benefits as now two checks are being sent, instead of one. As we saw in 2020, the IRS is not infallible when it comes to these calculations. Many taxpayers never received stimulus that should have been sent to them (though they should be made whole when they file their taxes). Given this, if you are in a position to file and your income fell from 2019 to 2020, it's probably still in your best interest to file ASAP.

Driving to our CPA like

What else might be included?

The stimulus checks are just one likely outcome from the next stimulus package. There is talk of many other things that might also be included. Among the provisions that would have a significant impact on a wide array of individuals and families:

Expanded child tax credit

A maximum of $3,600 for children under 6 and $3,000 for children between the ages of 6 and 17

The credit would be subject to income thresholds that are similar to those surrounding the stimulus. Single filers making less than $75,000 and joint filers making less than $150,000 would be eligible for the maximum credit and taxpayers above those thresholds would be eligible for a reduced credit.

This credit applies for the 2021 tax year

Expands the credit to include children who are 17 (children who turn 17 in any given tax year are not typically eligible for the child tax credit)

Eligible filers could receive this credit as a monthly payment rather than as a refund at tax filing. This would be optional and would reduce or eliminate the child tax credit normally received with a tax return.

Unlike most years, this credit would be made fully refundable. This means that if you have more credits than you do taxes, you can receive a refund for the difference. For example, let's look at a situation where your total tax bill is $5,000 for the year, but you're eligible for $6,000 worth of child tax credits. In most years, your tax credits would reduce your tax bill to $0, but you wouldn't be eligible to receive the remaining $1,000, because the credit isn't refundable (with some exceptions for low-income individuals). With this proposal, your tax bill would be lowered to $0 AND you would receive the remaining $1,000 as a refund!

Extending expanded unemployment benefits

Benefits would be extended from March 14, 2021 to August 29, 2021

Increase expanded unemployment benefits from $300 per week to $400 per week (starting March 14, 2021)

Increase in the number of weeks for which an unemployed worker is eligible to receive expanded benefits from 50 weeks to 74 weeks (ensuring that individuals who have been unemployed since early in the pandemic remain eligible to receive benefits)

Expanded, refundable dependent care tax credit for the 2021 tax year

Expanded credit would provide a large amount of relief for filers with dependent care expenses (daycare, nannies on official payroll, etc.)

Filers making less than $125,000 are eligible to receive a 50% tax credit on up to $8,000 of eligible childcare expenses ( for one child or $16,000 for two children.

Filers making between $125,000 and $400,000 are eligible to receive between 49% and 20% of eligible expenses

Filers making between $400,000 and $440,000 are eligible to receive between 19% and 1% of eligible expenses

Expanded dependent care FSA limit

$10,500 limit up from $5,000! for the 2021 tax year

In general, taxpayers making below $125,000 of income should utilize the expanded dependent care tax credit (up to the max) before paying for any qualifying expenses with a dependent care FSA. Filers above that threshold need to determine if the percentage tax savings (federal, FICA, state, and local) exceeds any credit for which they would be eligible.

Increased premium tax credits for those who purchase health insurance on the marketplace (applicable for 2021 and 2022)

Out-of-pocket premiums on the exchange are capped through a formula based on household size and income. If the premium for a policy exceeds this cap, the government funds the difference through tax credits.

Prior to this provision, taxpayers making more than 400% of the poverty limit were ineligible for a tax credit and their premiums were not capped. If this provision goes into effect, a cap will be put into place and they might be eligible for tax credits to help subsidize their cost.

While individuals are eligible for these credits, this provision will benefit mostly married couples and families, simply due to their insurance typically costing a higher percentage of their income.

Providing premium assistance to individuals who lose their job and purchase COBRA insurance

This provision would offer support to those who lost their job and want to remain on their former employer's health insurance.

The covered individual would be responsible for paying a percentage of the premium and the rest would be paid for them using funds appropriated in this bill.

Summary of things to consider:

If your income fell in 2020:

Consider filing your tax return ASAP to increase the potential for eligibility of a stimulus check

If your income rose in 2020:

Consider waiting to file your tax return until a stimulus package has been signed into law

If your income stayed mostly the same in 2020:

If you received the full payment for your family size the last two times ($1,200 per adult + $500/child the first round and then $600/adult or child the second round), file whenever you normally would

If you didn't receive the full payment for your family size the last two times, consider making an IRA or HSA contribution (assuming otherwise eligible) to reduce your 2020 income and increase your potential stimulus payment. File your return ASAP

If you had a child in 2020:

That child won't have been accounted for on your 2019 tax return. It may be advantageous to file your 2020 return ASAP to ensure that they are counted in the next round of stimulus.

If your income went up in 2020 AND you had a child in 2020, you will have to evaluate the tradeoffs of a potentially lowered benefit due to your 2020 income and a potentially higher benefit due to your larger family size.

If you currently contribute to a dependent care FSA and your income is below $125,000

Ask your employer if you can stop contributing for 2021. You will be better off claiming the dependent care tax credit than continuing your dependent care FSA.

We will have to wait and see what ends up making it into the final bill. What's pretty clear at this point, is that the stimulus package is poised to provide a lot of help to a lot of families. With all of these new or expanded programs, 2021 is likely to be a unique year from a tax standpoint. It will be important to stay informed about what these developments mean for you and your family, as well as whether there are any changes you need to make for your own personal situation. If you have any questions about these tax updates, we would love to help!

Comments